WhatsApp)

WhatsApp)

Goods and Services Tax (GST)/Harmonized Sales Tax (HST), a value-added tax levied by the federal government. The GST applies nationally. The HST includes the provincial portion of the sales tax but is administered by the Canada Revenue Agency (CRA) and is applied under the same legislation as the GST.

GST Rates - ( For Inter-state supply, IGST Rate is applicable | For intra-state supply, CGST rate and SGST/UTGST rate is applicable ) Goods which are not specified in table below have IGST tax rate of 18%.

the Québec sales tax (QST), which is calculated at a rate of 9.975% on the selling price excluding the GST. The GST and QST are collected on the supply of most goods and services. The harmonized sales tax replaces the provincial sales tax and the GST in some provinces.

Oct 29, 2018· Therefore, the state said, in this case, the supply of each component in the contract cannot have a flat tax rate of 5 percent GST, but instead must be 18%. A project developer informed Mercom that a representation on the issue has been forwarded to the government from the Solar Projects Developers Association (SPDA).

Goods and services tax (GST): Broadly, PNG's GST is imposed at the rate of 10% on the supply of most goods and services in PNG. The GST Act which came into force in 2003 defines the term "supply" as including all forms of supply, such as the sale, transfer, hire or lease of goods, and the provision of services.

Mining Tax Canada Canada's Mining Tax Resource. Income taxes: Canadian income taxes apply to virtually all forms of business activity that are either carried on in Canada or are carried on by a resident of Canada. These taxes are levied on the net (or "taxable") income of the entity conducting the business (including mining operations).

Nov 19, 2018· GST implication. The Haryana Authority of Advance Rulings (hereinafter referred to as "AAR") ruled that Mineral mining rights granted by the government will be liable to the Goods and Services Tax (hereinafter referred to as "GST") at the rate .

mining/petroleum companies respectively. Some mining/petroleum companies have concessionary tax rates with the government. Withholding taxes also apply to certain types of income for both residents and non-residents. Withholding tax on interest, dividends, and royalties paid to a non-resident is the final tax. Rates Non-resident companies

The details about GST rate changes for sale of machinery and machinery parts are being updated here. The notification changes on exemptions for GST for sale of machinery and machinery parts and other circulars related to GST for Machinery and Machinery parts are updated in this website. Update on 18th May, 2017: GST rates for goods

Jun 30, 2017· The capital goods sector will see a neutral to positive impact due to the GST roll-out. For air-conditioners it is neutral, industry cables will have a negative impact, pumps and motors will have a positive impact, and switchgears and construction and mining equipment will have a neutral impact due to implementation of GST. Source: Phillip Capital

Find details about Goods and Services Tax Rates and GST Slabs for Harmonized System of Nomenclature Codes Chapter 85 : Electrical Machinery Equipment Parts Sound.

This online document is intended to provide guidance to the Mining and Energy community through the publishing of resolved and unresolved GST Mining and Energy issues. All references to the 'GST Act' are referring to the A New Tax System (Goods and Services Tax) Act 1999.

Updated New GST tax slab rates list Dec 2019 for different goods and services. Check out the GST slabs rates in India and list of all items at Wishfin.

Impact analysis of GST on Mining Sector. Dated 17th March, 2017. ... The various activities of mining which is chargeable to service tax under the current regime would attract tax at the rate of 15% whereas supply of these services under GST would be taxed at the rate of around 18% which is higher than the current tax rate on the same. Thus ...

Sales Tax Rates by Province There are three types of sales taxes in Canada: PST, GST and HST. See below for an overview of sales tax amounts for each province and territory.

Below is a summary of the standard and reduced VAT (Values Added Tax) and GST (Goods & Sales Tax) rates across the world. Review detailed 2019 EU VAT rates for the 28 member states.

Jun 05, 2017· This is the List of Gst Tax Rates on surgical goods and Medical Equipment.like Nebulizers, Digital BP Monitors, Air Mattress Etc. The Gst rates on Medical Equipments have been decided by the Govt. We tried to interpret that which item of surgical goods falls in which HSN code or chapter. Infinity Mediquip India

Nov 15, 2017· GST Relief: Over 200 Items, Eating Out At Restaurants To Be Cheaper From Today The GST Council in its 23rd meeting last week approved the biggest ever change to the tax rates since the new tax ...

The GST rate of principal supply shall be applicable in this case i.e. GST rate as applicable to the mineral. Question 30. Exploration companies undertake exploration activities for preparing mining blocks for auction in different States in the country. They use rigs for exploration.

GST rates for all HS codes. You can search GST tax rate for all products in this search box. You have to only type name or few words or products and our server will search details for you. Tax rates are sourced from GST website and are updated from time to time. Note: You are adviced to double check rates with GST rate book. We update rates ...

Jul 31, 2018· The difference between GST/HST zero-rated and GST exempt goods and services in Canada and examples of each type to make charging GST/HST easier. ... Farm equipment such as tractors, seeders, planters, ... Sales Tax Rates for GST, HST, and PST.

Mining Taxation in Canada The mining industry is a highly cyclical and capital-intensive, with a long lead time between initial investment and commercial production. Accordingly, the federal and provincial income tax and provincial mining tax systems treat exploration and other intangible mining expenses generously.

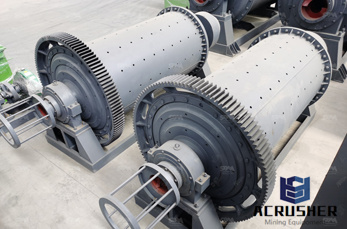

50 FAQs on GST on Mining Sector in India. editor | Goods and Services Tax - Articles; 01 Aug 2017; ... which does not include the mining equipment, viz., tippers, dumpers. Thus, as per present provisions, the GST charged on purchase of earth moving machinery including tippers, dumpers used for transportation of goods by a mining company will be ...

Aug 03, 2017· GST Impact on Mining Industry – FAQ's released by CBEC Question 1: Can small mining leaseholders with a turnover less than Rs.75 lacs operate under composition scheme? Answer: As per Sec. 10(1) of the CGST Act, 2017, a registered person whose aggr...

WhatsApp)

WhatsApp)