WhatsApp)

WhatsApp)

The MACRS Depreciation Calculator uses the following basic formula: D i = C × R i. Where, D i is the depreciation in year i, C is the original purchase price, or basis of an asset; R i is the depreciation rate for year i, depends on the asset's cost recovery period

Straight line depreciation is the most commonly used and easiest method for allocating depreciation of an asset. With the straight line method, the annual depreciation expense equals the cost of the asset minus the salvage value, divided by the useful life (# of years). This .

Straight Line Asset Depreciation Calculator. Enter the purchase price of a business asset, the likely sales price and how long you will use the asset to compute the annual rate of depreciation of that asset or piece of equipment. Calculator Savings. Initial cost of asset: Salvage Value of the Asset:

Depreciation is an accounting term that refers to the allocation of cost over the period in which an asset is used. In a business, the cost of equipment is generally allocated as depreciation expense over a period of time known as the useful life of the equipment.

To link to the entire object, paste this link in email, IM or document. To embed the entire object, paste this HTML in website. To link to this page, paste this link in email, IM or document

Depreciation is defined as the value of a business asset over its useful life. The way in which depreciation is calculated determines how much of a depreciation deduction you can take in any one year, so it is important to understand the methods of calculating depreciation.

Due to the complex and ever-changing nature of depreciation tax laws, please consider the results of the MACRS Depreciation Calculator to be for illustrative purposes only. In other words, be sure to consult a qualified tax professional and/or IRS Publication 946 before completing your depreciation-related tax .

MACRS accelerates depreciation by allowing the taxpayer to take larger deductions early in an asset's life and smaller deductions later. MACRS accelerates depreciation by allowing the taxpayer to take larger deductions early in an asset's life and smaller deductions later. ...

Depreciation, Depletion, and Amortization (DD&A) is an accounting technique associated with the acquisition, exploration, and development of new oil and natural gas reserves.

Depreciation Calculator: How To Calculate MACRS Depreciation. When it comes to calculating depreciation, I recommend that you let your tax software or your tax professional do the calculations for you. However, it is still good for you to understand how the formula works. The formula to calculate MACRS Depreciation is as follows:

Depreciation is an accounting method of allocating the cost of a tangible or physical asset over its useful life or life expectancy. Depreciation represents how much of an asset's value has been ...

To calculate depreciation subtract the asset's salvage value from its cost to determine the amount that can be depreciated. Divide this amount by the number of years in the asset's useful lifespan. Divide by 12 to tell you the monthly depreciation for the asset.

Calculate the straight-line depreciation of an asset or, the amount of depreciation for each period. Find the depreciation for a period or create a depreciation schedule for the straight line method. Includes formulas, example, depreciation schedule and partial year calculations.

The most common types of depreciation methods include straight-line, double declining balance, units of production, and sum of years digits. There are various formulas for calculating depreciation of an asset. Depreciation expense is used in accounting to allocate the cost of a tangible asset over its useful life.

Nov 21, 2018· How to Calculate Depreciation Recapture. Calculate the depreciation that was allowable for all years including the year you sold the asset. Add this back to the basis of the asset, then find the difference between the selling price and the basis. Examine the depreciation that was allowed, including in the year of disposal.

Depreciation calculators online for primary methods of depreciation including the ability to create depreciation schedules. Also includes a specialized real estate property calculator. Straight-Line Depreciation Calculator. Calculate depreciation used for any period and create a straight line method depreciation schedule.

Straight Line Depreciation. Straight-line depreciation is the most common method used to calculate depreciation, and that amount is applied to your company's asset over its useful life. The steps involved in calculating it are: Determine the cost of the asset. Determine the salvage value of the asset. Determine the asset's useful life in years.

MACRS Depreciation Calculator Help. The MACRS depreciation calculator adheres to US income tax code as found in IRS Publication 946 (opens in new tab). Above is the best source of help for the tax code. If you have a question about the calculator and what it does or does not support, feel free to ask it in the comment section on this page.

The coal in the mine would be exhausted after 15 years. The equipment would be sold for its salvage value of $250,000 at the end of 15-year period. The company uses straight line method of depreciation and does not take into account the salvage value for computing depreciation for tax purpose. The tax rate of the company is 30%. Required:

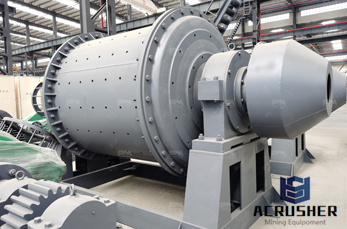

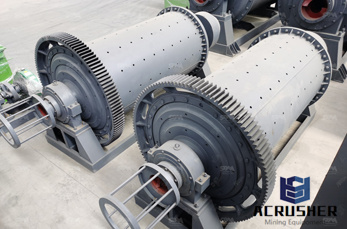

calculating depreciation of mining equipment Circular No. 45/2013/TT-BTC - ACCA Global. The calculation of depreciation according to this Circular are made for each fixed asset (hereinafter referred to prolong the utilization time of fixed assets; introduction of new production technology process that reduces the The enterprise determines the time of depreciation of the mining machine is 15 ...

Jul 11, 2018· Consider this example: Company A buys a new piece of equipment, the Widget, for $100,000. The Widget has a useful life of 10 years. Without depreciation, Company A would show $100,000 in expenses ...

What is Depreciation?. In accounting terms, depreciation is defined as the reduction of recorded cost of a fixed asset in a systematic manner until the value of the asset becomes zero or negligible.. An example of fixed assets are buildings, furniture, office equipment, machinery etc..

From the classification of mining income to deductions, depreciation schedules for rig equipment to having a second reporting and tax requirement after the mined coins are sold, tax rules for ...

Depreciation and Amortization in Mining Industry: By Harpreet Sandhu Lecturer, Depreciation and Amortization:, This is a simple method of calculating depreciation (ii) In this method, asset can be depreciated up to the estimated scrap value or zero value (iii) In this method, it is easy to know the amount of depreciation .

WhatsApp)

WhatsApp)